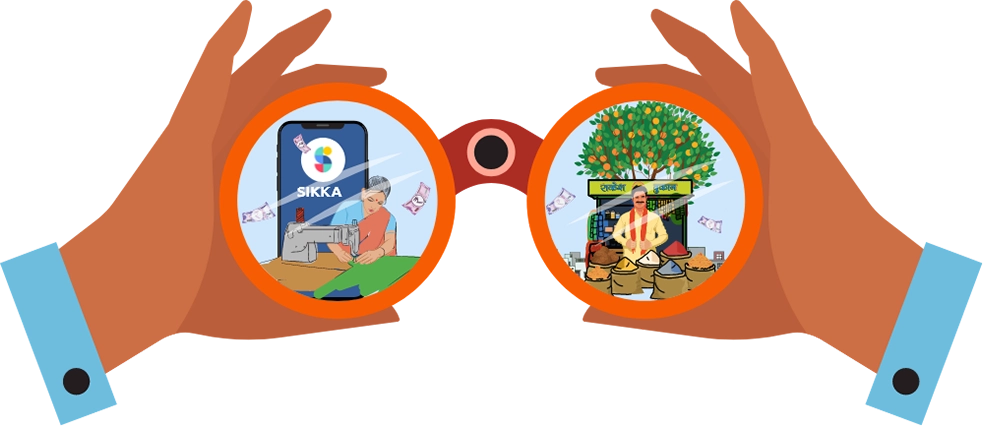

Moneyboxx aims to pave the way for financial inclusivity by ensuring that every entrepreneur, with a greater focus on three segments - women entrepreneurs, livestock rearing communities, and new-to-credit borrowers, has access to capital. This approach is our route to fostering economic prosperity in Bharat.

Lives of borrowers impacted (including co-borrowers)

of our customers are first-time borrowers and new-to-credit borrowers

of our customers are women entrepreneurs

Moneyboxx Finance is an impact-investing NBFC which is dedicated to the vision of inclusivity and growth. We seek to empower small business entrepreneurs through innovative financial solutions and drive economic growth within Bharat through income generation and job creation. Our secured and unsecured, fast and flexible business loans empower our customers, helping them expand their business. Beyond business, we pursue various initiatives that can enhance the livelihood and well-being of communities that we interact with.

Utkarsh Small Finance Bank Limited (USFBL),(NSE/BSE UTKARSHBNK) incorporated on April 30, 2016, is engaged in providing banking and financial services with a focus on providing microfinance to the underserved and unserved sections of the country. The Bank’s lending activities are primarily focused in rural and semi-urban locations of the country while its other services are spread across the country.

The Bank extends microfinance loans based on Joint Liability Group (JLG) model to individuals, other retail asset loans including Micro, Small and Medium Enterprise (MSME) Loans, Housing Loans (HL), Personal Loans, Commercial Vehicle Loans, Construction Equipment Loans and Wholesale Lending to borrowers.

The Bank is headquartered at Varanasi, Uttar Pradesh.

Founded in 1995, MAS is a non-banking financial company registered with the Reserve Bank of India, offering diverse retail finance solutions. It caters to the needs of lower and middle-income groups by providing Micro Enterprises Loans, SME Loans, Home Loans, Two-Wheeler Loans, Used Car Loans, and Commercial Vehicle Loans. With a network of 185+ branches across Gujarat, Maharashtra, Rajasthan, Madhya Pradesh, Tamil Nadu, Karnataka, and New Delhi, MAS ensures accessible financial services across urban, semi-urban, and rural areas.

Vivriti Capital Limited (formerly known as Vivriti Capital Private Limited) is a fintech NBFC that aims to bring necessary debt finance to hundreds of mid-market enterprises across India. Pioneers in deepening the under-penetrated market and building appetite toward mid-market enterprises, Vivriti manages a portfolio of INR 8800+ Cr across 400+ enterprises and 50+ sectors. In the last six years, Vivriti has built significant expertise and a robust business model through specialized technology, curated products, multi-level underwriting, superior portfolio management and highly effective distribution. With a highly varied product suite, Vivriti enjoys 90%+ client retention and has delivered these unparalleled numbers in the most challenging macro environment that India has seen.

at the 2nd Annual NBFC and FinTech Excellence Awards 2023

in the category of Outstanding Customer Engagement Initiative

Special mention in Business World 2nd Edition Festival of Fintech Conclave Awards 2022

Conferred for the category - Outstanding Customer Experience